does instacart automatically take out taxes

Stride is a free app that makes it simple to find and. Read our full guide to Instacart taxes.

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

If you cant find a refund in your bank account you may have.

. You will need to pay taxes. As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per. Everyone out there serving for.

Taxes and fees Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order. This stuff applies just as much for Instacart Uber Eats Grubhub Postmates. How do I use the Stride app to help file my taxes.

Instacart does not take out taxes for independent contractors. Heres how it works. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them.

No taxes are taken out of your Doordash paycheck. You just let it auto track your deposits from Instacart and go from there. Under District law Instacart has been responsible for collecting sales tax on the delivery services it provides.

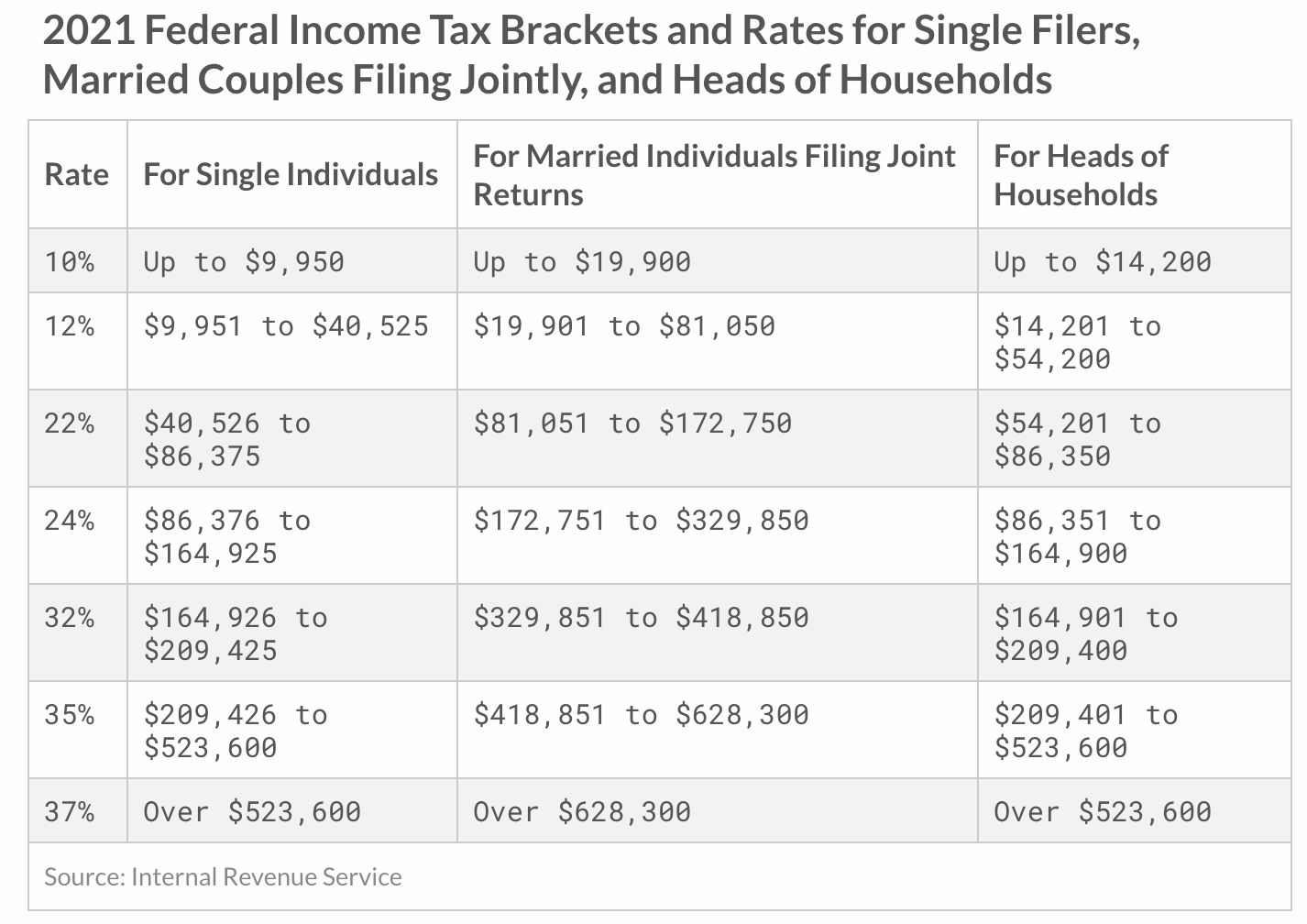

Both tells you what you will need to submit for quarterly tax payments. The IRS establishes the. You do get to take off the 50 ER.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. But the entire time Instacart has operated in the District it has. This is a standard tax form for contract workers.

The tax andor fees. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes. According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour.

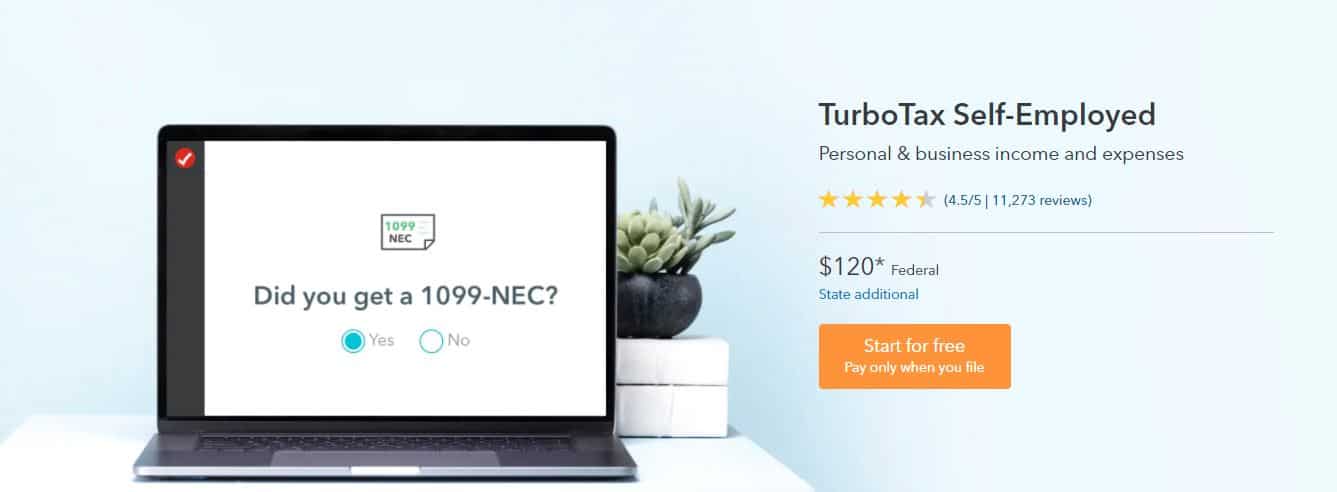

Generally you cant use the free version to file self-employed tax forms. Does Instacart take out taxes for its employees. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year.

The short answer is yes. Stride or quickbooks self employed. If you are an in store shopper yes if you are a full service shopper no.

Per the IRS you are considered an independent contractor if you work for Instacart and you should receive an Instacart 1099 form in the mail. But if you choose to work as an Instacart full-service shopper. Plan ahead to avoid a surprise tax bill when tax season comes.

3015 reviews from Instacart Shoppers employees. They will owe both income and self-employment taxes. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis.

Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Does Instacart take out taxes.

What You Need To Know About Instacart Taxes Net Pay Advance

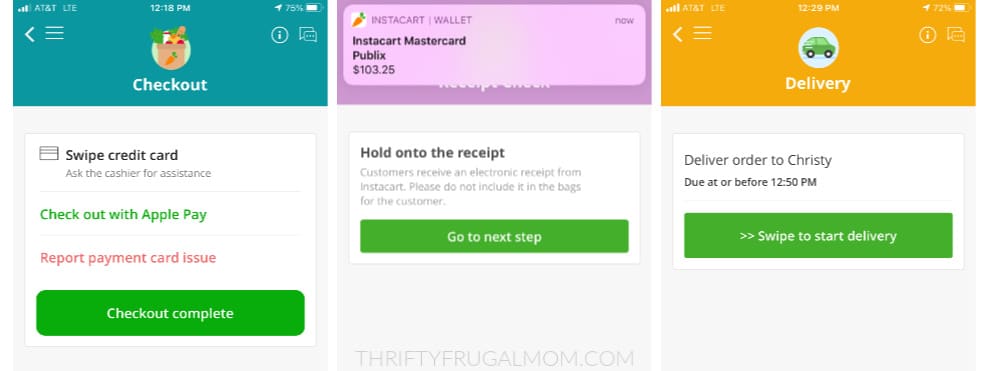

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

How To Get Doordash Tax 1099 Forms Youtube

Everlance Automatic Mileage Tracker Expense Management

Instacart Ipo What You Need To Know Forbes Advisor

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

Guide To 1099 Tax Forms For Instacart Shopper Stripe Help Support

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

The Ultimate Guide To Self Employed Taxes Everlance

Does Instacart Track Mileage The Ultimate Guide For Shoppers

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

What You Need To Know About Instacart 1099 Taxes

Instacart And Chase Launch New Instacart Mastercard Credit Card Unlocking New Rewards And Unlimited Earnings From Hundreds Of Retailers Business Wire

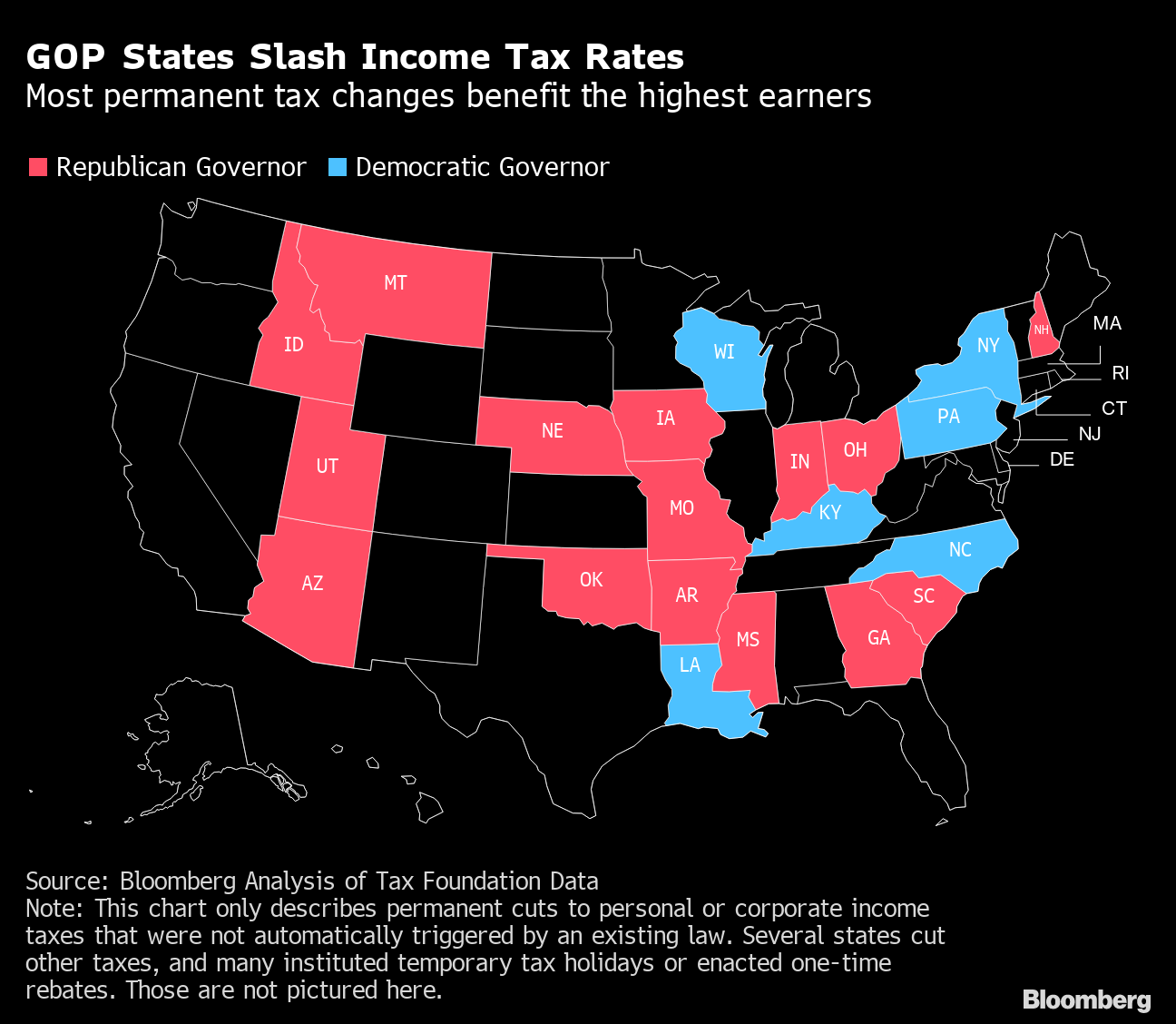

Us States Slash Taxes Most In Decades On Big Budget Surpluses Bloomberg

Is Instacart Worth It For Drivers Know The Truth

Dave Ramsey A Side Hustle Can Help Your Debt Free Journey Pick Up Speed Facebook